Kelly Criterion Betting Explained: System to Calculate Optimal Bet Size

What is Kelly's Formula

In probability theory, the Kelly Criterion, also known as the scientific gambling method or the Kelly formula, Kelly strategy, or Kelly bet, is a mathematical formula for sizing bets or investments that lead to higher wealth compared to any other betting strategy in the long run. It is one of the few betting strategies with a formula or proof elaborating why it can deliver a higher return in the long haul than any other system.

Essentially, the Kelly Criterion is a mathematical formula for sizing bets or investments that lead to higher wealth compared to any other strategy in the long run.

This gambling method can determine the optimum amount of money an investor or bettor can invest or wager on an opportunity. The bet size of the Kelly criterion is found by optimising the anticipated value of the logarithm of wealth, which is equal to maximising the expected geometric growth rate. With this strategy, users bet a predetermined fraction of assets while considering the amount of money available to use and the expected returns.

How to Use Kelly's Criterion

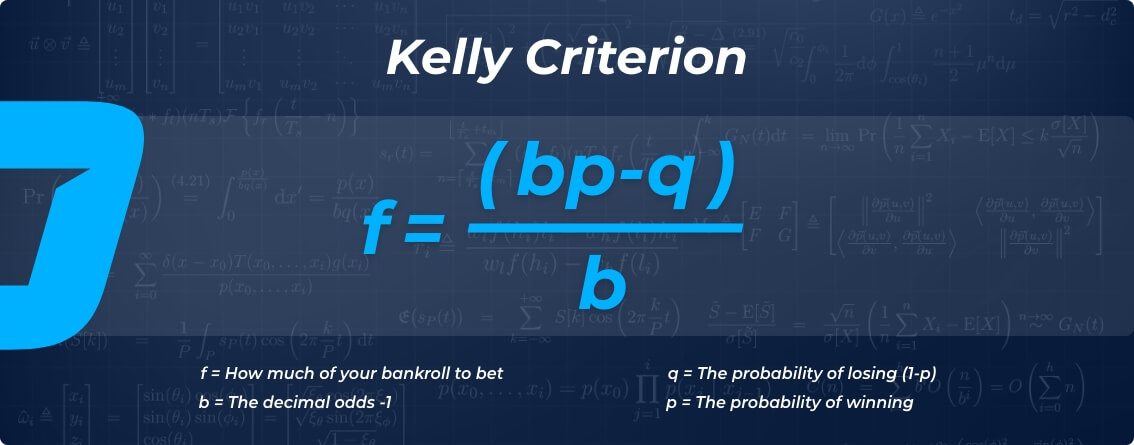

The Kelly strategy formula is, in principle, straightforward - it is about having a bet size as large as the probability of a win, less the likelihood of a loss. It also calculates the optimal amount to guarantee the most excellent chance of success. The formula is:

Using a dice as an example of Kelly Criterion staking

When you roll a dice, the probability of landing on a 1, 2, or 3 is 50%, with the same applying to an outcome of 4, 5, or 6. Let's assume the dice is biased and has a 55% chance of resting on a 1, 2, or 3. This means the chances of it landing on a 4, 5, or 6 is 45%. The variables will be:

- P = 1

- Q = 0.55

- Q = 1 - 0.55 = 0.45

Based on the Kelly formula, f = (1 x 0.55 - 0. 45) / 1 = 0.10 or 10%

The strategy, therefore, suggests that you wager 10% of the portfolio at 10% of the bankroll. If the dice bias was less, at 51%, the Kelly formula recommends that you stake at 2%. In such a scenario, the strategy suggests that if a bettor or investor were to go above 10%, there is a high probability they would lose the wager.

On the other hand, staking less than 10% would lead to smaller but consistent profits. Therefore, adhering to the Kelly strategy will optimise your capital growth rate in the long term.

Kelly Criterion Example in Sports Betting

The goal of the Kelly formula is not to go broke. The equation can be used to calculate the amount to bet on so that you can survive and keep playing. It states the correct amount of money to wager relative to the size of your betting bankroll.

From a sports betting perspective, let's say a proposed wager has odds of 3.00. The probability of winning is 0.40, making the probability of losing 0.60.

(( 3 x 0.40) - 0.60 ) / 3 = 0.20

Based on the formula, you should stake 0.2 (i.e. 20%) of your bankroll on the proposed wager. While the chances of failing are more significant than the chances of succeeding, it is a bet with a positive expected value due to the favourable odd sizes. Doing this, in theory, means the overall returns will be higher in the long run, and the overall losses will be lower.

When used with your preferred modelling tools and sports analytics, the Kelly strategy can establish value on the odds board and guide you on the amount you should wager.

Bet $5, Get $150 in Bonus BetsNo code required Claim bonus

Bet $5, Get $150 in Bonus BetsNo code required Claim bonusNew customers only. 21+. Wager your first $5+ and if you win, you'll be awarded $150 in bonus bets. Gambling Problem? Call 1-800-GAMBLER. FanDuel Sportsbook available in AZ, CT, CO, IA, IL, IN, KS, KY, LA, MA, MD, MI, NJ, NY, NC, PA, OH, TN, VA, VT, WV, WY only. Full T&Cs apply.

Up to a $500 Second-chance BetClaim bonus

Up to a $500 Second-chance BetClaim bonusPayout on Free Bet wagers includes profits only(stake not returned). Must be 21+ and physically present in U.S. T&Cs apply.

Up to $1,500 back in Bonus BetsClaim bonus

Up to $1,500 back in Bonus BetsClaim bonusPlace your first wager and receive up to $1,500 back in Bonus Bets if the bet loses. If the bet does lose, your Bonus Bets will be available once your initial wager is settled. Must be 21+ and located in the U.S. T&Cs apply. Please Gamble Responsibly!

Get $100 when you bet $20No code required Claim bonus

Get $100 when you bet $20No code required Claim bonusFree bets will be broken down into 10 x $10 bets. Must be 21+ and located in the US at time of wagering. T&Cs apply.

Bet $5, Get $200 + No Sweat NBA SGP TokensNo code required Claim bonus

Bet $5, Get $200 + No Sweat NBA SGP TokensNo code required Claim bonusRegardless of the outcome of the wager the bonus will be awarded as six(8) $25 Bonus Bets. Must be 21+ years of age or older and physically located in the U.S(AZ, CO, CT, IA, IL, IN, KS, KY, LA (select parishes), MA, MD, ME, MI, NC, NJ, NY, OH, PA, TN, VA, VT, WY or WV). New customers only. T&Cs apply.

Conclusion

The Kelly strategy can be used to find the optimal bet size for a wager. Not only can it be used for casino games and sports matches, but it can also be used in the stock market. The good thing about the Kelly Criterion is that it offers a distinct advantage over other staking strategies - it is a lower-risk strategy and guarantees profits in the long run.

- It offers good protection against losses. You lose less in case of prolonged failures as the bank decreases with a decrease in the subsequent stake

- Allows you to earn frequently. A higher bankroll increases the rate, which enables you to increase the gain significantly

- It prevents placing wagers where a positive expected value does not exist

- The strategy does not consider the volatility of the market and the effects variance can have on outcomes

- A bettor's specific investing constraints can override the desire for a maximum growth rate

- Managing multiple edges on concurrent bets with the Kelly strategy is hard

Kelly Criterion Betting System FAQ

❔ Who was Kelly?

🏆 Is the Kelly Criterion Betting Strategy Illegal?

💶 Is the Kelly Criterion System Allowed in Bookmakers?

💳 Is Kelly's Criterion a Safe Method for Betting?

🤔 Can I Bet on Football with The Kelly Criterion Formula?

The Kelly strategy applies to almost all forms of gambling, including wagering on football. It is even one of the most favoured methods of football betting as it promises to provide higher profits when compared to other betting strategies.

- Wikipedia contributors. (2022a, January 7). Kelly criterion. Wikipedia. https://en.wikipedia.org/wiki/Kelly_criterion

- Thorp, E. The Kelly Criterion in Blackjack, Sports Betting, and the Stock Market. Paper presented at The 10th International Conference on Gambling and Risk Taking. 1997.